Highlights

• Corporate-guaranteed Tesla lease – backed by BBB S&P rating, $758.65B market cap, and $97.69B (2024) revenue • Adjacent to Fayette Pavilion, Georgia’s largest open-air shopping center (4.7M annual visitors; Walmart, Target anchors) • Prime I-85 location – Fayetteville’s main retail corridor (30,800+ VPD) with top national retailers and QSRs nearby • New 10-year absolute NNN lease – 10% rent increases every 5 years, no landlord responsibilities, four 5-year renewal options starting Jan 2025 • Tesla occupies 3.77-acre pad in new retail development with corporate QSR co-tenants • High-demand trade area: 105K residents, $92.7K average income, limited new entry via redevelopment only

Description

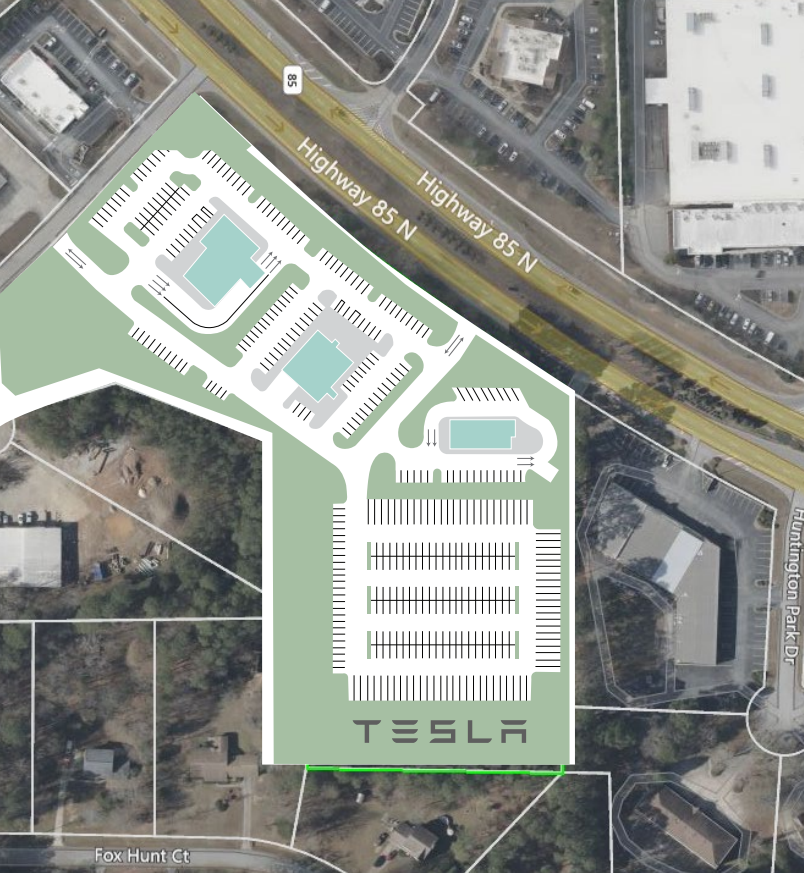

Faris Lee Investments is pleased to present the opportunity to acquire a single-tenant Tesla investment property located within one of Georgia’s most densely populated and highly trafficked retail corridors. The property is secured by a brand-new 10-year absolute NNN lease with zero landlord responsibilities and 10% rent increases every five years. The lease is corporately guaranteed by Tesla, Inc. (NASDAQ: TSLA), an investment-grade tenant rated BBB by S&P, and supports surplus vehicle inventory for Tesla’s nearby showroom and service center located just a quarter mile away. The asset is part of a newly developed retail project positioned along Interstate 85 (±30,800 VPD), directly across from Fayette Pavilion—the most visited open-air shopping center in Georgia, attracting over 4.7 million annual visitors and anchored by major retailers including Target, Walmart, Home Depot, and Publix. The surrounding trade area draws from a dense population exceeding 400,000 residents across Fayetteville, Riverdale, Jonesboro, Tyrone, and southern Atlanta. Tesla occupies 3.77 acres within this development, joined by nationally recognized QSR co-tenants Pollo Campero, Jim ‘N Nick’s, and Walk-On’s Sports Bistreaux—all secured by long-term, corporately guaranteed ground leases and currently under construction. Each outparcel may be purchased individually or as part of a portfolio. In 2024, Tesla reported $97.7 billion in revenue, continuing to expand its vehicle and energy divisions. Its use of this location for surplus vehicle inventory underscores the brand’s growing footprint in Georgia, one of the few states where it is permitted to sell directly to consumers. This offering represents a premier, management-free investment in a high-growth Atlanta submarket, backed by one of the world’s most innovative and investment-grade tenants.

Property Documents

193 Walkwer Pathway OM.pdf

5.56 MBListing Details

- Cap Rate

7.75%

- Tenancy

Single

- Space Type

Specialty

- Sub Category

Auto Dealership

- Date Listed

10/24/2025

- Net Operating Income

$363,000

- Building FAR

1

Property Specifics

- Property Name

TESLA - 10 Year NNN Lease | 193 Walker Pkwy

- No of Stories

1

- Year Built

2024

- Building Size

164,221 SF

- Lot Size

3.77 Ac